“Thanks my solar panel, I will earn two Bitcoins that I will spend at a local fruit and vegetable producer”. Known as a blockchain, this technology, used by cryptocurrencies such as Bitcoin, is booming. Is it a good idea? Can it be trusted?

Blockchain technology could be very useful in managing the complexity of some of the components of the energy transition, such as the integration of the great capacity of power generation from renewable sources. What is this technology and what are its potential applications to energy? Are the regulation and business models well enough defined for it to be applied to the energy sector? What about its intrinsic energy consumption?

1. History of Blockchain

Blockchain is a technology that was developed to facilitate cryptocurrency. It was born out of the mistrust of a small community of developers towards the centralized banking system and traditional markets after the 2008 crisis [1]. Long confined to this small community in various countries around the world, its notoriety exploded in 2017 due to the democratization and popularization of cryptocurrencies, such as Bitcoin: nearly 3 million people currently own it according to the University of Cambridge.

1.1. Bitcoin in 2008

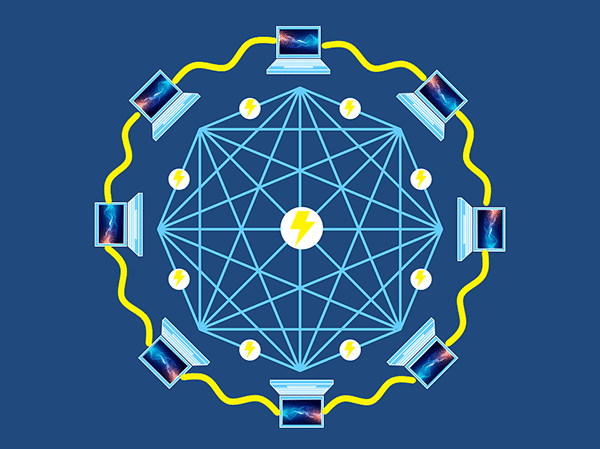

The concept of blockchain appeared with the creation of Bitcoin in 2008 and Satoshi Nakamoto’s White Paper[2]. With a name derived from the combination of “bit” (the unit of binary information in computing) and “coin” (a unit of money), this innovation followed the collapse of the famous investment bank Lehman Brothers, one of the consequences of which was the refusal to put blind trust in a centralized organization to guard liquid assets (Image 1). Bitcoin is the first cryptocurrency that will allow peer-to-peer payments[3].

Bitcoins are generated in accordance with a protocol that pays individuals for processing transactions. These individuals use their computing power to verify, secure and record transactions in a virtual registry, called the blockchain, a sort of forgery-proof, decentralized ledger.

As a currency or commodity, Bitcoins can be exchanged for other currencies or commodities, goods or services. The exchange rate for cryptocurrency is set mainly in specialized market places and fluctuates according to the law of supply and demand. The system operates without a central authority nor a single administrator, but in a decentralized manner thanks to the consensus of all the nodes in the network. The transactions are validated using computers belonging to “miners” who are themselves paid in Bitcoin. According to the Cambridge Center for Alternative Finance, “as of April 2017, the combined market value of all cryptocurrencies is $27 billion,” a value comparable, according to the study, to that of Silicon Valley companies such as Airbnb.

1.2 What is a blockchain?

According to the definition of Blockchain France, blockchain is a technology for storing and transmitting information, which is transparent, secure and operates without a central review body.

By extension, a blockchain constitutes a database containing the history of all exchanges between its users since its creation. This database is secure and distributed: it is shared by its various users, without intermediaries, in a decentralized manner, allowing each user to check the validity of the chain.

The key word here is “decentralized”, since a blockchain forms a public, permanent and immutable record, whose coherence and integrity are maintained by the network participants, without any control entity, central servers or trusted third parties[4]. In other words, it eliminates the need for a trusted third party to centralize all the information.

All these data are compiled in a single file, which is then replicated on all the computers participating in the blockchain. The synchronization of the data record between all participants is essential since it guarantees its immutability. All participants must have the same information regarding the transactions performed. The principle of the blockchain consists in creating a temporary list of pending data (this list constitutes a block) and then verifying and sharing this list in a timed manner using a cryptographic verification process. This process is at the heart of the security of the technology. Once the new block has been verified, it is added to the blockchain and the process begins again.

1.3. Who operates a blockchain?

In the case of public blockchains, participation is open to anyone. This participation, called “mining”, is paid for in the cryptocurrency associated with the blockchain (Bitcoins for the Bitcoin blockchain, ethers for the Ethereum blockchain, for example). While everyone can participate in theory, practice shows that mining has become a very competitive market and is now mainly carried out by huge mining farms with great computing capacity in countries where electricity is available at low cost, such as Iceland or China (Image 2).

Image 2: A mining farm in Iceland. [Source: Marco Krohn [CC BY-SA 4.0 (https://creativecommons.org/licenses/by-sa/4.0)], via Wikimedia Commons]

2. Blockchain applications in the energy sector

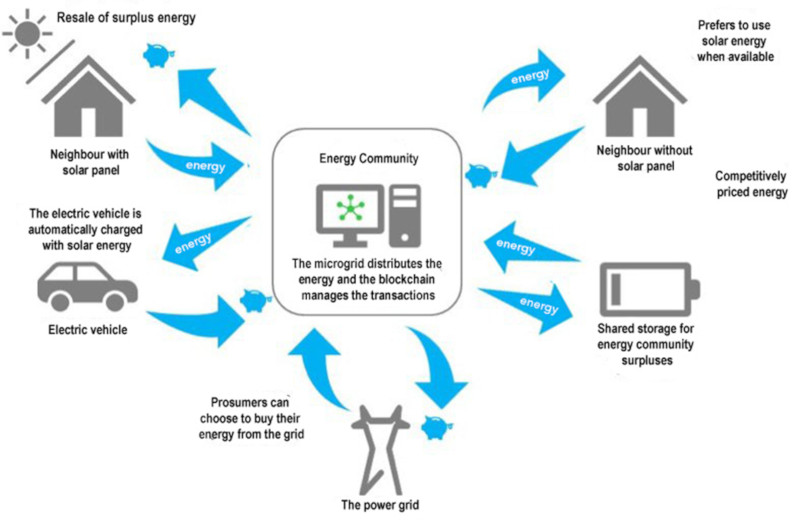

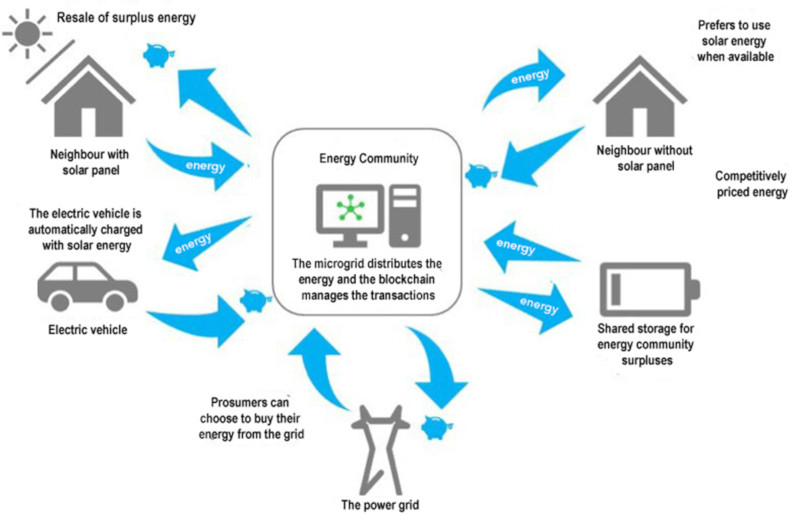

Applied to the electricity sector, the blockchain offers new opportunities to legitimize, secure and automatically enhance energy transfers between producers and consumers, without going through a centralized intermediary (supplier). This paradigm shift makes the blockchain a relevant lever for consuming and exchanging electricity on a local loop (Read: Le numérique au service d’une gestion dynamique de l’énergie, Digital technology for dynamic energy management). This has implications for different energy sectors, such as the energy communities of Europe and a few other places in the world, and the electrification of areas that currently have no access to energy, such as certain regions of Africa and Asia. It is interesting to note that these two applications would seem to converge from a technological point of view without being the result of the same electrification process (Image 3 and Image 7). Finally, the advent of the electric vehicle could also use this technology to enable smarter battery charging.

The sharing of apartments and cars, crowdfunding, and the desire to consume on short circuits are all trends that are transforming our economy at an unexpected rate, as evidenced by the development of digital companies such as Blablacar and Airbnb. Energy seems to be following this movement and would thus be in line with the vision outlined by Jeremy Rifkin in his book The Third Industrial Revolution. Tomorrow, “thanks to my solar panel, I will earn 2 bitcoins that I will spend at a local fruit and vegetable producer”[5]. This is what blockchain technology can do.

2.1. Energy communities in Europe and elsewhere

The concept of an energy community has recently appeared in Europe. A new model of energy production and consumption called Local Energy Communities (LECs) has developed and is in the process of emerging on a global scale. In the context of the EU Electricity Directive (2009/72/EC) and according to the Winter Package of 30 November 2016, it is defined as “an association, a cooperative, a partnership, a non-profit organization or other legal entity that is controlled by local shareholders or members, rather than being profit-driven, involved in decentralized generation and in the activities of a distribution system operator, supplier or aggregator at the local level, including beyond its borders”[6].

The participation of citizens in a local energy community can thus lead to the creation of a local market, favoring the optimization of supply and demand at the local level while facilitating the integration of renewable energies and allowing for the expansion or profitable operation of the network. These groups of “prosumers” (both producers and consumers) can become important catalysts of the energy transition by promoting electromobility and energy savings, stimulating energy exchanges and encouraging the creation of intelligent microgrids while increasing the energy efficiency of the actors (Read: Microgrids: how do they contribute to the energy transition?).

The “tokenized” economy[7] associated with blockchain is currently booming. Blockchain technologies can be seen as a technological layer capable of providing several functionalities, such as a secure database to certify the origin of electricity, qualities and sources, transaction records, asset tokenization, and value exchange between market players. These functionalities can clearly pave the way for the realization of decentralized peer-to-peer market structures[8].

The creation of new energy communities seems to be fostered by blockchain technologies (Image 3).

Image 3: Schematic diagram of an energy community using blockchain technology. [Source: Chris Martin, How Blockchain Is Threatening to Kill the Traditional Utility, Ljubljana Slovenia June 2018. CIRED]

With blockchain, microgrid users will be able to directly exchange energy in real time. Their electricity transaction would be legal, transparent, secure and monetized via the blockchain. Electricity distributors would act as neutral facilitators of energy communities by harnessing and providing data through the deployment of smart meters, though business models and regulations would need to evolve for this to be possible (Read: Compteur communicant, Smart Metering).

2.2. The Brooklyn Microgrid energy community experiment

Brooklyn Microgrid (Image 4) is an energy community project on a neighbourhood scale. The project is supported by the State of New York, through the New York State Energy Research and Development Authority (NYSERDA). This energy community currently consists of 150 homes. The announced objectives of the project are to encourage the development of microgrids to improve the resilience of the electricity grid in the face of natural disasters, to develop local renewable energy and to promote energy efficiency and intelligent demand management. The project is being developed by the TransActive Grid joint venture composed of two young companies: LO3 Energy, a consulting company developing decentralized systems in energy and environment, and ConsenSys, a startup developing applications in blockchain technology.

Image 4: Residents of Brooklyn have created their micro-grid of green energy, facilitated by blockchain technology . [Source: LO3 ENERGY]

The first step was to create a local energy market, which requires the ability to exchange and price energy directly and locally. To do this, it was necessary to increase the number of smart meters and to assign value to the locally produced energy through tokenisation. If a producer/consumer produces more green energy than he consumes, then he has a surplus of energy. This surplus is sold back to the grid in exchange for tokens. These tokens can then be exchanged locally. They constitute a local energy currency, which functions similarly to other traditional, non-virtual local currencies.

2.3. Access to energy in Africa

In 2016, 1.1 billion people in the world had no access to electricity. 80% of these people without electricity live in rural areas and 600 million in Sub-Saharan Africa. (Read: L’électrification rurale en Afrique Sub-saharienne, Rural electrification in Sub-Saharan Africa).

In order to deal with this lack of access to electricity, several electrification models are emerging to bring electricity to isolated areas, including the concept of lateral electrification[9]. This is a concept that is halfway between centralized power grids and individual electrification solutions like small individual solar panels. In fact, electrification such as we have seen in Europe with massive investments in centralized infrastructure is no longer possible today in Africa.

Such top-down electricity infrastructure development programs, based on massive national planning and public investment, could only be achieved in countries where public financial capacity and political stability were sustainably combined and where the density of energy demand was from the outset very high, due to high human concentration or the initial presence of energy-intensive industrial processes.

Unfortunately, such conditions are not met in the countries where most of the non-electrified populations live today and are unlikely to be met in the majority of them in the near future. Moreover, even if such centralized electrification were possible, it would not meet the objectives of the energy paradigm shift which requires the integration of a large share of renewable energy to be in line with the COP21 climate objectives (Read: Microgrids: how do they contribute to the energy transition?).

Other electrification solutions are all the more reasonable given that individual electrification models have been developing for several years now that allow for the supply of small power on the scale of a family home. They bring together different technologies for the autonomous production of electricity for the needs of individual customers. Covering a wide range of prices and service levels, they have in common that they are designed to meet the basic needs of families or small businesses, independently of any grid (Image 5).

These systems range from small solar lanterns to solar home systems and/or small generators. By providing a rapid response to the urgent needs of populations far from any electricity grid, these systems have already improved the living conditions of millions of Africans. However, they are not an optimal and sustainable response to the energy problems of isolated areas in Africa, as their limited power does not allow for the supply of higher-powered machines (agricultural machinery, water pumps, motorization), which are essential for the economic development of these areas. (Read: De l’énergie pour l’Afrique non raccordée au réseau : diagnostic et De l’énergie pour l’Afrique non raccordée au réseau : solutions, Energy for Africa Not Connected to the Grid: Diagnosis and Energy for Africa Not Connected to the Grid: Solutions).

Image 6: Renewable energy-based electrification system for Africa for a housing group, village or farming community.

Both approaches, large infrastructure and individual electrification, thus have their limitations. The intermediate model of lateral electrification involves designing and deploying on a large scale a new model of progressive and modular electrification, based on renewable energy, new information and communication technologies, and local human resources (Image 6). In the same way that it has already done for its telecommunications infrastructure, Africa could leapfrog a technological step by turning away from the centralized electrification model of the 20th century and jumping directly to a decarbonized, decentralized, and intelligent electrical infrastructure, like the energy communities that industrialized countries are dreaming of today. The lateral electrification model[10] strongly resembles the electrification model of energy communities previously discussed from a technological point of view.

In the African context, one of the great expectations regarding the intelligence of electricity systems is the security and transparency of the purchase and sale of electricity by suppressing monetary cash transactions in order to limit expensive travel in rural areas and prevent any diversion by field sales agents. System intelligence, in particular the use of blockchain technology combined with smart meters, could be one solution to address this (Image 7).

2.4. Other energy applications

The use of blockchains is not limited to energy communities or electrification of non-electrified areas. It can have implications for all types of peer-to-peer exchange that can be monetized and controlled by computer software tools. The use of blockchain technology can, for example, be applied to electricity recharging terminals, to allow the recording of electricity transactions and their accounting follow-up in complete transparency and without possible error.

Several initiatives are currently emerging. SolarCoin, a virtual currency that rewards solar electricity producers, is recognized by the International Renewable Energy Agency (IRENA). For every MWh of solar energy produced, 1 SolarCoin is awarded to the producer. These tokens can then be exchanged on a marketplace without intermediaries. Only supply and demand will determine the price of energy. For its part, the start-up Grid Singularity, in partnership with IBM and LO3 Energy, is implementing this technology for developing countries in areas with little or no connection to the distribution network[11].

3. Technical and regulatory impediments

The application of blockchains to energy activities is still in its infancy. In order to move forward, various obstacles will have to be overcome.

3.1 Energy consumption

According to Digiconomist’s Bitcoin Energy Consumption Index (BECI), each individual Bitcoin transaction consumes up to 275 kWh of electricity. The latest estimate of Bitcoin’s total annual energy consumption is 29.05 TWh per year, equivalent to 0.13% of the world’s total annual energy consumption. If the Bitcoin blockchain was a country, it would rank 61st in terms of global electricity consumption and would exceed, for example, the annual electricity consumption of a country such as Ireland[12].

The process responsible for the high electricity consumption of the Bitcoin blockchain is the block validation process, which consists of the solving of a mathematical problem (proof of work) requiring very high computational capacity. This validation process was written into the basis of the Bitcoin blockchain almost ten years ago and is not modifiable for this particular blockchain. However, since 2008, blockchain technology has undergone a meteoric evolution with the development of alternatives to the validation process used in the Bitcoin blockchain, which are much less energy consuming and faster.

The new blockchains are and will therefore be much less energy consuming than the one associated with Bitcoin, often cited as an example.

3.2. Energy regulation and pricing

In 2018, blockchain applications are in their early stages, and thus raise a number of uncertainties regarding their industrial implementation. Indeed, although the technology has very high potential, it is still in the development phase and many projects remain at the Proof Of Concept (POC) stage.

In this context, the lack of a framework can be seen as both a challenge and an opportunity[13]. While blockchain technology offers a viable option that is easy to implement in all types of networks, it also raises many regulatory and market economy issues. The incumbents, who are indirectly affected by this local peer-to-peer management, will have to face the multiplication of local energy markets in competition with the global energy market. These interactions could disrupt the market, as the energy produced is no longer directly linked to its price[14].

In France, for example, self-consumption results in the non-payment of the TURPE (Tarif d’utilisation des réseaux publics d’électricité, a fee paid for use of the public electricity grid), which is necessary for the operation, maintenance and development of the power grid. Thus, if collective self-consumption were to increase thanks to blockchain technologies, it would be necessary to change the tariff system in order to guarantee the modernization of the public grid and its fair remuneration[15].

3.3. Can blockchain technology be trusted?

Can blockchain technology guarantee contractual obligations?

Smart contracts are one of the illustrations of the use of a blockchain to secure contractual transactions[16]. These computer protocols automatically execute the terms of a contract; their objective is to satisfy contractual conditions, such as the terms of payment or delivery, but also those of confidentiality, and even the performance of reciprocal obligations. As a result, the digital and automated nature of the contract allows two partners to enter into a business relationship without the need for prior trust, an outside authority or central intervention. It is the system itself, and not its agents, that guarantees the honesty of the transaction.

A blockchain can be compared to a big book of accessible and auditable accounts, registered on the Internet. It relies on a very large number of computer resources distributed around the world, called nodes that participate in its operation. In the case of a public blockchain, anyone can contribute; all that is needed is a computer of sufficient power and the execution of the associated code[17].

All in all, blockchain technology is based on strong conceptual principles that naturally position it as the trusted technology par excellence[18].

- Its decentralized architecture and the neutrality of its governance are based on the principle of consensus: relying on a very large number of independent contributors, it is decentralized by nature. This means that, unlike a centralized architecture where decisions can be taken unilaterally, it is necessary to reach a consensus or to manage to control more than 50% of the computing power of a blockchain (computing resources) in order to have an effect on the system. For example, any change in governance rules must first be approved by consensus by the contributors, who must then update the executed software code.

- The transparency of the algorithms offers better auditability: any transaction, any block, any governance rule is freely accessible and readable by anyone; as such, anyone can audit the system to ensure the proper functioning of the blockchain and the legitimacy of the transactions. The advantage is that it allows experts from the user community to scrutinize the code and raise the alarm in case of suspicion. The reliability of the system therefore depends on the whistleblowers.

- The underlying technologies are secure because the cryptographic techniques and methods of use guarantee that a blockchain cannot be altered, that the transactions entered are authentic, even if they are issued under a pseudonym, and finally that the security of a blockchain is able to keep up with technological developments thanks to an adaptive level of security.

Conclusion

Blockchain technology applied to energy could contribute to the development of energy communities in industrialized countries and to the electrification of areas where people do not yet have access to energy through a process of lateral electrification. Energy communities and lateral electrification thus converge through common technologies such as blockchains. The interest lies mainly in making the purchase and sale of electricity secure and transparent by eliminating direct monetary transactions. Other applications around the electric vehicle and the production of renewable electricity are also developing. Nevertheless, certain impediments relating to business models and regulatory systems must first be resolved, particularly through the various pilot projects that are emerging today. This is a prerequisite for the large-scale development of this technology.

Notes et references

[1] Recall that a developer is a programming analyst, i.e. a computer scientist who creates software and implements it using a computer language.

[2] Satoshi Nakamoto: Bitcoin: A Peer-to-Peer Electronic Cash System.

[3] Peer-to-peer: a direct exchange between two entities without a third person, called a trusted third party (e.g. a bank), having to guarantee the conditions of the transaction.

[4] Trusted third party: a trusted third party is a body authorized to implement electronic signatures. This recent term is used in several different areas, such as the exchange of goods, the exchange of information on the Internet, French tax declarations, etc.

[5] Mazars La blockchain, c’est quoi ? 2 mai 2018, Smarts grid CRE

[6] Georgia ASIMAKOPOULOU & Nikos HATZIARGYRIOU from National Technical University of Athens National Technical University of Athens, School of Electrical and Computer Engineering School: Models for the Integration of Local Energy Communities in Energy Markets. Ljubljana Slovenia June 2018. CIRED

[7] Tokenization consists of converting the rights to an asset into digital tokens on a blockchain. This means, for example, that the price of a quantity of energy x is y tokens.

[8] Giovanni VELOTTO & Ritwik MAJUMDER from ABB Sweden. Microgrids for Decentralized Energy Markets Based on Blockchains: Ljubjiana Slovenia June 2018. CIRED

[9] Marc BOILLOT, Alain DOULET, Nicolas SAINCY from Algorus Consulting et foundation Tuck. Electrification latéral : vers un nouveau modèle d’électrification pour l’Afrique. 1er Mai 2018.

[10] Marc BOILLOT, Alain DOULET, Nicolas SAINCY from Algorus Consulting et foundation Tuck. Electrification latéral : vers un nouveau modèle d’électrification pour l’Afrique. 1er Mai 2018.

[11] Guillaume Guérard, Zeinab Nehai : Quand la blockchain sert à s’échanger de l’électricité. ESIL Pole Leonard de Vinci.

[12] Mazars La blockchain, c’est quoi ? 2 mai 2018, Smarts grid CRE

[13] Giovanni VELOTTO & Ritwik MAJUMDER from ABB Sweden. Microgrids for Decentralized Energy Markets Based on Blockchains: Ljubjiana Slovenia June 2018. CIRED

[14] Guillaume Guérard, Zeinab Nehai : Quand la blockchain sert à s’échanger de l’électricité. ESIL Pole Leonard de Vinci.

[15] Mazars La blockchain, c’est quoi ? 2 mai 2018, Smarts grid CRE

[16] Thierry Ménissier : La blockchain : peut-on réinventer technologiquement la confiance ? 2 mai 2018 Université Grenoble Alpes, the conversation.

[17] Guillaume Guérard, Zeinab Nehai : Quand la blockchain sert à s’échanger de l’électricité. ESIL Pole Leonard de Vinci.

[18] Maryline Laurent Peut-on faire confiance à la blockchain ? 16 avril 2018, CNRS SAMOVAR.

The Energy Encyclopedia is published by the Association des Encyclopédies de l’Environnement et de l’Énergie (www.a3e.fr), contractually linked to the University of Grenoble Alpes and Grenoble INP, and sponsored by the French Academy of Sciences.

To cite this article, please mention the name of the author, the title of the article and its URL on the Energy Encyclopedia website.

The Energy Encyclopedia articles are made available under the terms of the Creative Commons Attribution-Noncommercial-No Derivative Works 4.0 International License.